For current info please visit detroitmi.gov

Pay As You Stay

Keep Your Home Detroit!

HOPE and PAYS work together to keep qualifying Detroiters in their home!

The City is urging all residents in need of current year property tax relief to apply for the Homeowners Property Exemption (HOPE). The final 2024 Deadline for the HOPE application is November 1, 2024.

Step 1. HOPE

The Homeowners Property Exemption (HOPE), formerly known as HPTAP, is an application where Detroit homeowners must apply annually to be exempt from their current year property taxes. If approved, you will still be responsible for any fees such as the solid waste fee. Homeowner Property tax exemptions are granted at 100%, partial 75%, 50%, 25%, or 10% (For those at risk of tax foreclosure).

Step 2. PAYS

The Pay As You Stay (PAYS) program allows Detroit homeowners who are HOPE approved to receive a reduction on past due property taxes that are being collected by the Wayne County Treasurer’s Office.

Step 3. DTRF

The Detroit Tax Relief Fund (DTRF) is administered by Wayne Metro to pay off the remaining property tax balances of Detroit residents who have been approved for HOPE and PAYS. Call (313) 244-0274 to speak with someone from the Detroit Tax Relief Fund Hotline.

What is PAYS?

“Pay As You Stay” is for HOPE-approved homeowners with unpaid delinquent taxes that reduce the burden of those taxes.

- For certain qualified residents, the balance due of unpaid delinquent taxes will be limited to back taxes only (interest, fees, and penalties removed) or 10% of a home’s taxable value – whichever is less. *The outstanding delinquent taxes must be greater than 10% of the taxable value of your home.

- The remaining balance could be paid back over a period of up to three years at zero percent interest and all interest, penalties and fees will be canceled at the completion of the Pay as You Stay Payment Agreement (PAYSPA).

- Homeowners who pay off the reduced balance within the first 90 days, will be eligible for an additional reduction in delinquent taxes.

- City of Detroit Residents who are approved for PAYS are eligible to have their entire balances paid in full by the Detroit Tax Relief Fund.

How will I know if I am approved for PAYS?

Homeowners who have been approved for HOPE become eligible for PAYS and will receive an enrollment letter from the Wayne County Treasurer's Office. A purple PAYS button will also appear when conducting a property search on the Wayne County Treasurer's Website.

**If you have delinquent taxes and do not qualify for HOPE or were denied, the Wayne County Treasurer's Office offers various plans to assist distressed taxpayers with paying delinquent taxes. Click here to make an appointment.

What if I need help completing my HOPE Application?

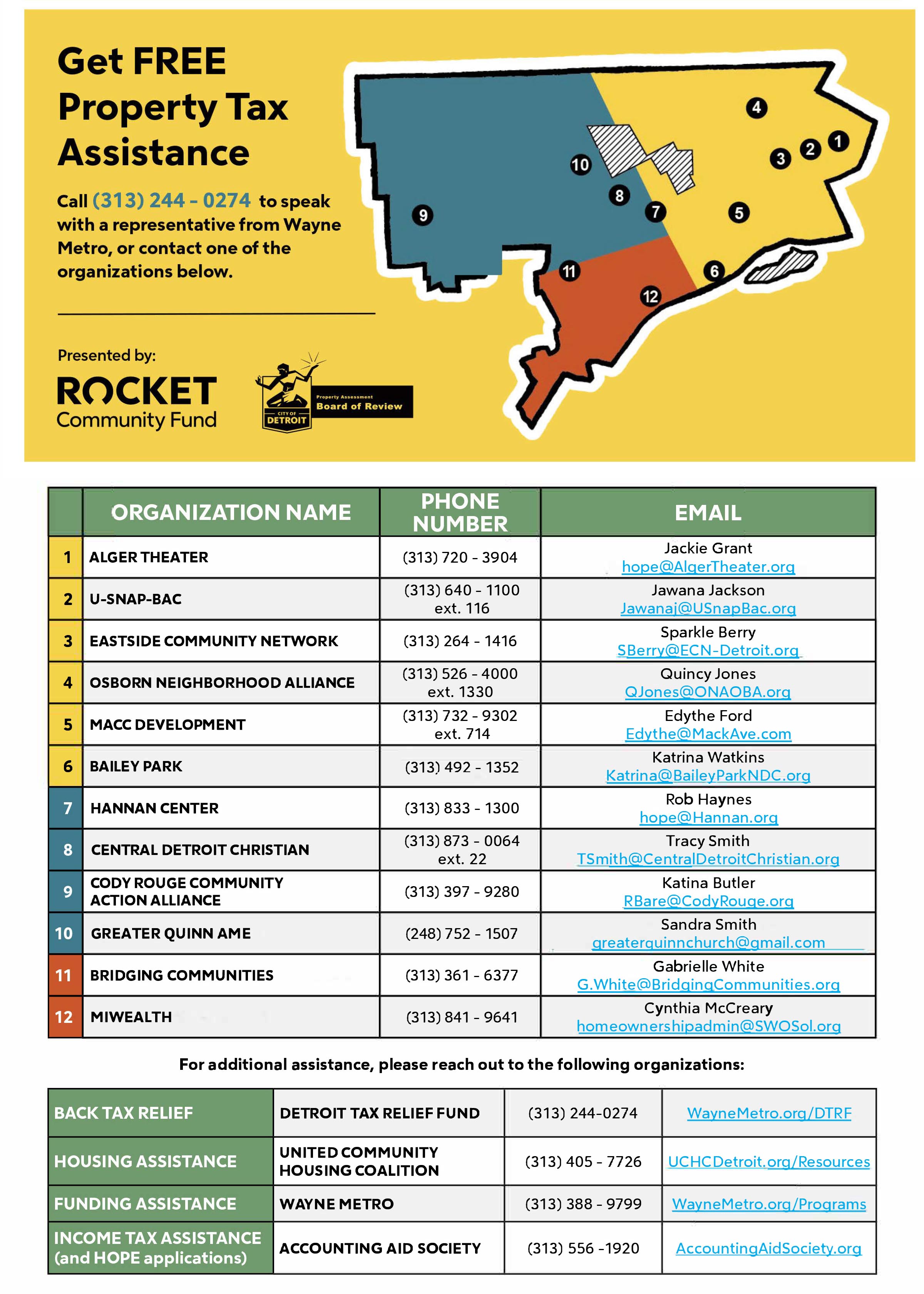

Quicken Loans Community Fund has partnered with the City and 11 non-profit partners to provide assistance to residents for both the online HOPE application and/or the paper HOPE application, to ensure applications are completed properly with the necessary documentation. You can also schedule an appointment online at https://detroithope.timetap.com/.

For complete eligibility requirements and more information on HOPE please visit: Homeowners Property Tax Assistance Program