For current info please visit detroitmi.gov

Homeowners Property Exemption (HOPE)

block-detroitminew-views-block-news-events-block-1,News & Events*block-detroitminew-views-block-related-links-block-1,Related Links*block-detroitminew-views-block-video-playlist-block-1,Videos*documents-block,Documents*block-detroitminew-views-block-forms-block-1,Forms*block-views-block-faq-block-1,FAQs*block-detroitminew-views-block-district-map-block-1,District Map*block-views-block-council-office-directory-block-1,Office Directory*block-detroitminew-views-block-contacts-block-3,Contacts*block-detroitminew-views-block-contacts-block-4,Contacts*block-detroitminew-views-block-council-member-bio-block-1,Bio*block-detroitminew-views-block-sub-sections-block-1,Sections*block-detroitminew-views-block-web-apps-block-1,Web Apps*block-detroitminew-views-block-news-events-block-4,News*block-detroitminew-views-block-news-events-block-3-2,Events*block-detroitminew-views-block-contacts-special-block-1,Staff*block-detroitminew-views-block-statements-block-1,Statements*block-detroitminew-views-block-newsletters-block-1,Newsletters*block-detroitminew-views-block-newsletters-block-3,Ordinance*block-detroitminew-views-block-newsletters-block-2,Resolutions*block-detroitminew-views-block-newsletters-block-4,Memos

HOMEOWNERS PROPERTY EXEMPTION (HOPE)

BOARD OF REVIEW MEETINGS (Click Here)

2024 HOPE APPLICATION

In accordance with MCL 211.7u, Detroit City Council has adopted a resolution allowing the acceptance of 2024 HOPE Applications through November 7, 2025. Scroll down for further information.

2025 HOPE APPLICATION

2025 E-HOPE APPLICATION

If you cannot pay your taxes for financial reasons, you may be able to reduce or eliminate your current year’s property tax obligation with the Homeowners Property Exemption (HOPE). Residents who are approved for (HOPE) are eligible for Pay as You Stay (PAYS), which reduces delinquent property taxes owed to the Wayne County Treasurer.

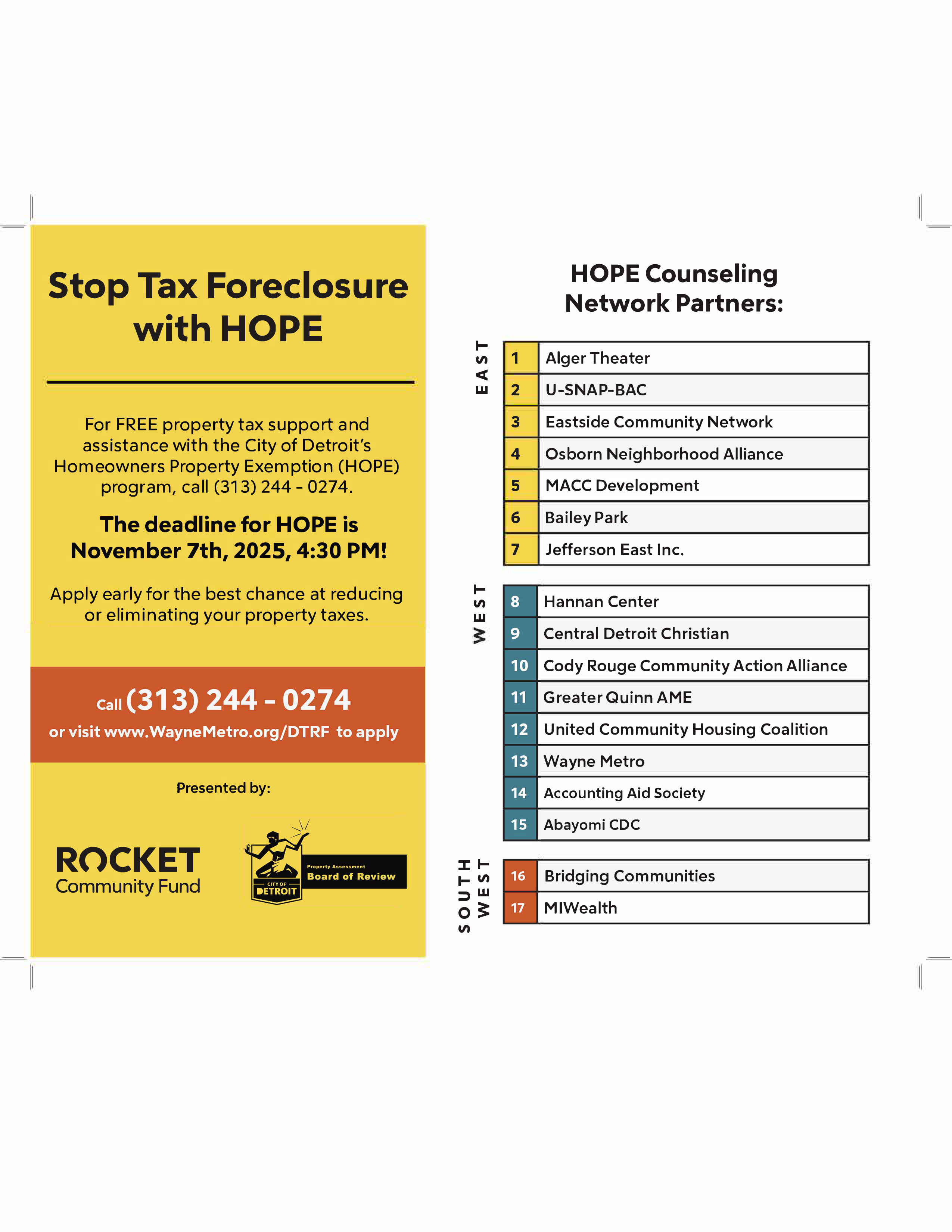

Residents seeking HOPE application assistance can make an appointment with a community partner by clicking the link below.

For delinquent property tax information or payment plans, reach out to the Wayne County Treasurer's Office.

CLICK HERE TO SCHEDULE A HOPE APPOINTMENT

What is a HOPE (formerly HPTAP)?

HOPE stands for Homeowners Property Exemption. It is also referred to as the Poverty Tax Exemption, “PTE” or Hardship Program. HOPE provides an opportunity for homeowners to be exempt from their current year property taxes based on household income. If approved, you will still be responsible for any fees such as the solid waste fee. The solid waste fee is discounted to $125 for HOPE approved homeowners single family home. The HOPE application is an annual application, homeowners must apply every year.

Do I qualify?

Eligibility for the HOPE is based on whether you own and occupy your home as your primary residence and your household income or circumstances. Please review the income levels listed below. Most homeowners whose income is below the guidelines are generally approved.

Only the Board of Review may approve an application.

2025 HOMEOWNERS PROPERTY EXEMPTION (HOPE)

INCOME GUIDELINES

Number in Household | Maximum Income for Full (100%) Exemption | Maximum Income for Partial (75%) Exemption | Maximum Income for Partial (50%) Exemption | Maximum Income for Partial (25%) Exemption | Maximum Income for Partial (10%) Exemption

|

1 | $20,783.00 | $22,289.00 | $23,945.00 | $26,957.00 | $40,527.00 |

2 | $25,141.00 | $26,776.00 | $28,207.00 | $31,069.00 | $49,025.00 |

3 | $27,886.00 | $29,435.00 | $30,984.00 | $33,824.00 | $54,378.00 |

4 | $32,448.00 | $34,008.00 | $35,568.00 | $38,688.00 | $63,274.00 |

5 | $36,580.00 | $38,409.00 | $39,872.00 | $42,799.00 | $71,331.00 |

6 | $41,960.00 | $43,638.00 | $45,317.00 | $48,254.00 | $81,822.00 |

7 | $47,340.00 | $49,234.00 | $50,654.00 | $53,494.00 | $92,31300 |

8 | $52,720.00 | $54,302.00 | $55,883.00 | $59,046.00 | $102,804.00 |

Add $5,380.00 to the income limit for each household member above eight for a 100% exemption. For a 75% exemption add $5,541.00 to the income limit for each household member above eight. For a 50% partial exemption add $5,703.00 to the income limit for each household member above eight. For a 25% partial exemption add $6,026,00 to the income for each household member above eight. For a 10% exemption add $10,491.00 for each household member above eight.

10% exemption requires property to be in threat of tax foreclosure or at least 20% loss of household income from the prior year (as approved by the State Tax Commission).

In addition, the total household assets (i.e. , other real property, boats, campers, stocks, bonds, IRA's, other assets in or out of the United States, etc.) SHALL NOT exceed $12,000.00. Verification of additional assets will be done for all parties and household members applying for property tax assistance. Information not provided by the applicant but is discovered by the Board of Review may cause your application to be denied. If you have assets totaling more than $12,000.00.

What do I need to provide?

To be considered for an exemption on your property taxes, the applicant is required to submit the following to the Board of Review:

- A completed Michigan Department of Treasury Form 5737 (Application for MCL 211.7u Poverty Exemption) and Form 5739 (Affirmation of Ownership and Occupancy),

- Registered proof of ownership (Deed, land contract, probate court order, divorce judgment etc.),

- Any form of government ID with address and picture of the homeowner and all residents over the age of 18,

- Proof of income for ALL members of the household (this includes any minor children). Examples: W2’s, paystubs, SSI/SSD, pension FIA/DHS, child support, self-employment, signed and notarized letter from who is helping you financially, etc.

- 2024 Federal and State tax returns for all adults, if filed (if are not required to file a tax return, the adult must complete a Michigan Treasury Form 4988 Poverty Exemption Affidavit and can provide W2’s, social security statements, or any other document that proves the past year’s income),

- Proof of residency for all minors in the household (such as FIA Statement, Report Card, Transcript, minor listed on tax return, etc.)

The Board of Review reserves the right to request additional information or documents.

2025 applications are required to be filed by 4:30 P.M. November 7, 2025.

Where can I find an application?

IMPORTANT: When using the online portal, you must complete and submit the application and provide supporting documentation in order for your application to be received by the Board of Review.

2025 HOPE APPLICATION

You can download the application by clicking on the link above, pick up a form at the Detroit Tax Service Center, Coleman A. Young Municipal Center 2 Woodward Avenue - Suite 130, or request a form mailed to your home by calling 313-224-3035 or emailing [email protected]

What is the deadline?

- 2025 applications are required to be filed by 4:30p.m. November 7, 2025. Applications are processed at an ongoing basis

- Be sure to file early to make sure the Board of Review has time to look over your case

- You must reapply each year

- If you are granted an exemption at either the July or December BOR, you will receive a full property tax bill in July. An adjusted tax bill will be mailed after the July or December BOR. If you pay your tax bill and are then granted an exemption, you will be mailed a refund for the excess payment.

- If you are not granted an exemption, you will receive an explanation in your decision letter. This will include the process and timeline for appealing this decision if you choose to do so.

2024 HOPE APPLICATION

In accordance with MCL 211.7u, Detroit City Council has adopted a resolution allowing the acceptance of 2024 HOPE Applications through November 7, 2025

The process is for new 2024 HOPE applications only. If a HOPE decision was rendered for the 2024 tax year, your application will not be considered in 2025. Applications received after November 1, 2024 will not receive a decision until the July Board of Review or December Board of Review depending upon the submission date and completeness of the application. Applications may be submitted with supporting documentation to the Coleman A. Young Municipal Center 2 Woodward Ave. Suite 130, Detroit, MI 48226 Monday through Thursday 8:30am - 4:00pm.

Online submission for the 2024 and 2025 HOPE Applications will begin January 6, 2025.

2024 E-HOPE APPLICATION

CLICK HERE TO DOWNLOAD 2024 HOPE APPLICATION

Need Assistance?

Residents seeking assistance to complete their HOPE (formerly HPTAP) application can reach out to one of the 11 non-profit partners listed below. The partners can assist in completing the online or paper HOPE (formerly HPTAP) application. You can also schedule an appointment online at https://detroithope.timetap.com/.

Is there any other help for my property taxes?

Our community partners have been successful in assisting property owners, even those who don’t qualify for the HOPE; find more information here. In addition, if you need assistance with your 2024 and prior taxes, you may visit the Wayne County Treasurer’s Office website here.

ADDITIONAL INFORMATION ABOUT YOUR TAX BILL

When are my taxes due?

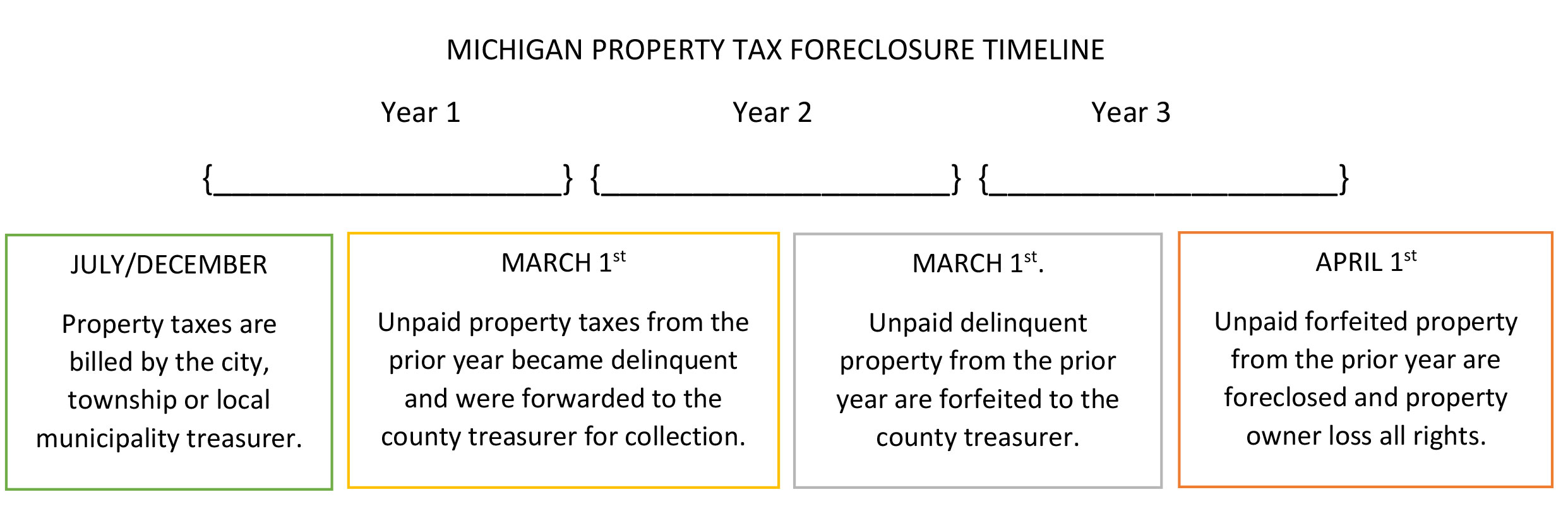

In the City of Detroit you will receive two (2) tax bills. The summer becomes due as of July 1st. You must pay one half of the summer bill by August 15th or all of the summer bill by August 31st to avoid any interest or penalties. You will receive a winter tax bill that becomes due December 1st. The bill must be paid by January 15th in order to avoid any interest or penalties.

All households, regardless of exemptions, are responsible to pay the annual $250 solid waste disposal fee on their summer tax bill, although qualifying seniors may receive a $125 discount.

What if I miss the payment deadline?

Are there other ways I can reduce my tax obligation?

- Property Assessment Appeal (must appeal between February 1st through February 22nd)

- (seniors 65 and older with household income of $40,000 or less)

- NEZ-Homestead Neighborhoods